In today’s digital age, Flipkart stands as a leading e-commerce platform, famous for its wide range of products and user-friendly interface. With a huge range of products ranging from electronics and fashion to home essentials and more, Flipkart has cemented its position as the preferred destination for online shopping in India.

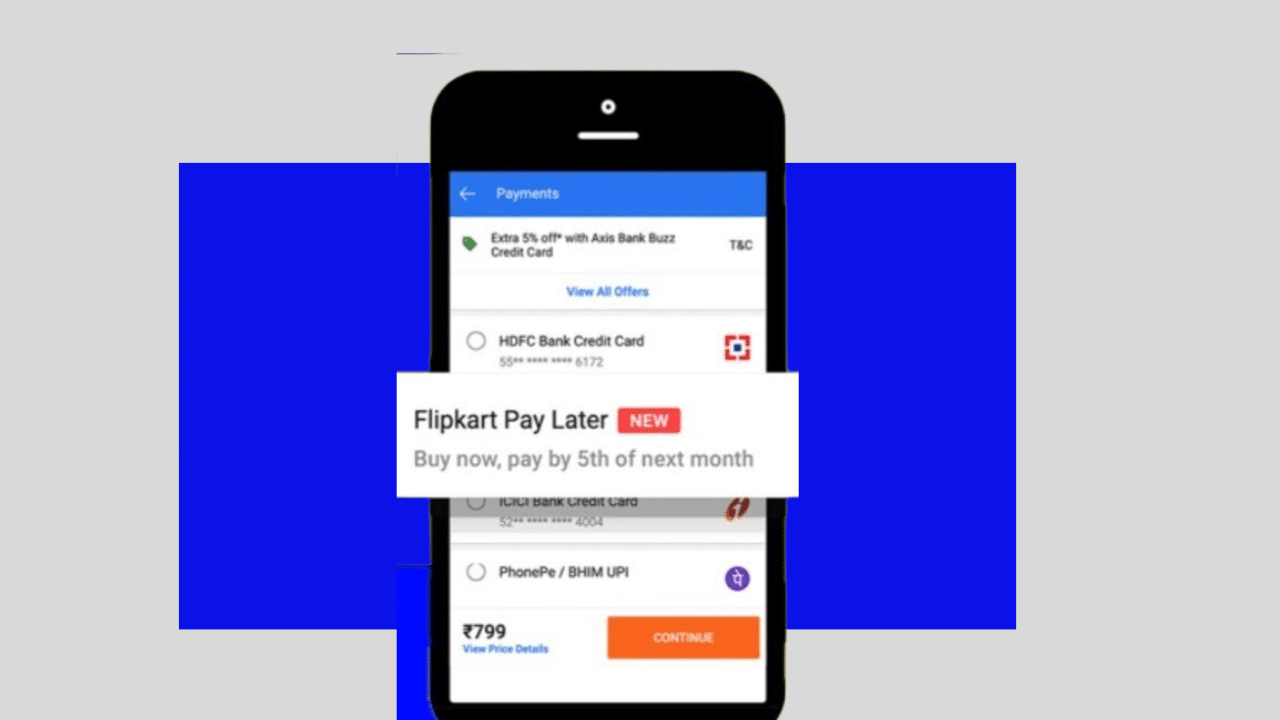

Flipkart is an online marketplace that offers a convenient payment option known as Flipkart Pay Later.

However, sometimes such a condition arises which will require closing your Flipkart Pay Later account. Today through this blog post article we will give step by step guide about “How to Close Flipkart Pay Later”.

This article will tell you three easy ways to close a Flipkart Pay Later account.

3 Ways To Close Flipkart Pay Later Account

| 1. Through App or Website | https://www.flipkart.com/ |

| 2. Via- Call | 1800-208-9898. |

| 3. Via – Email | Cs@flipkart.com |

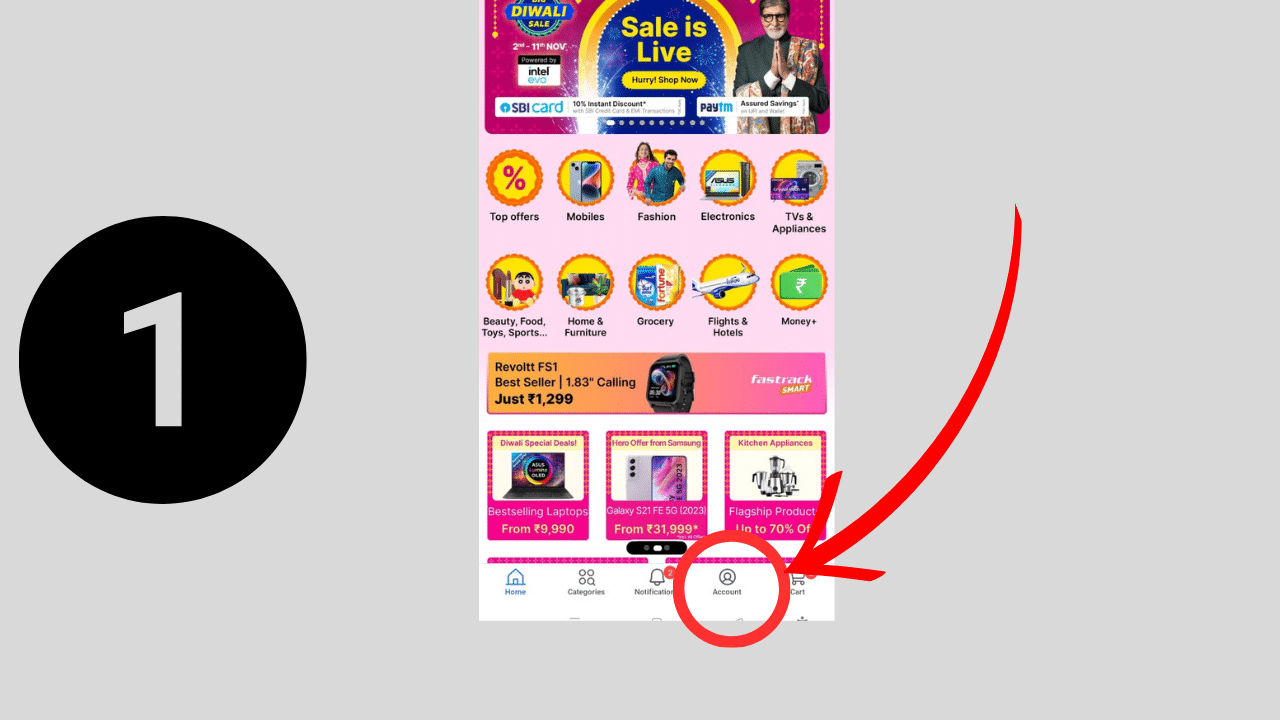

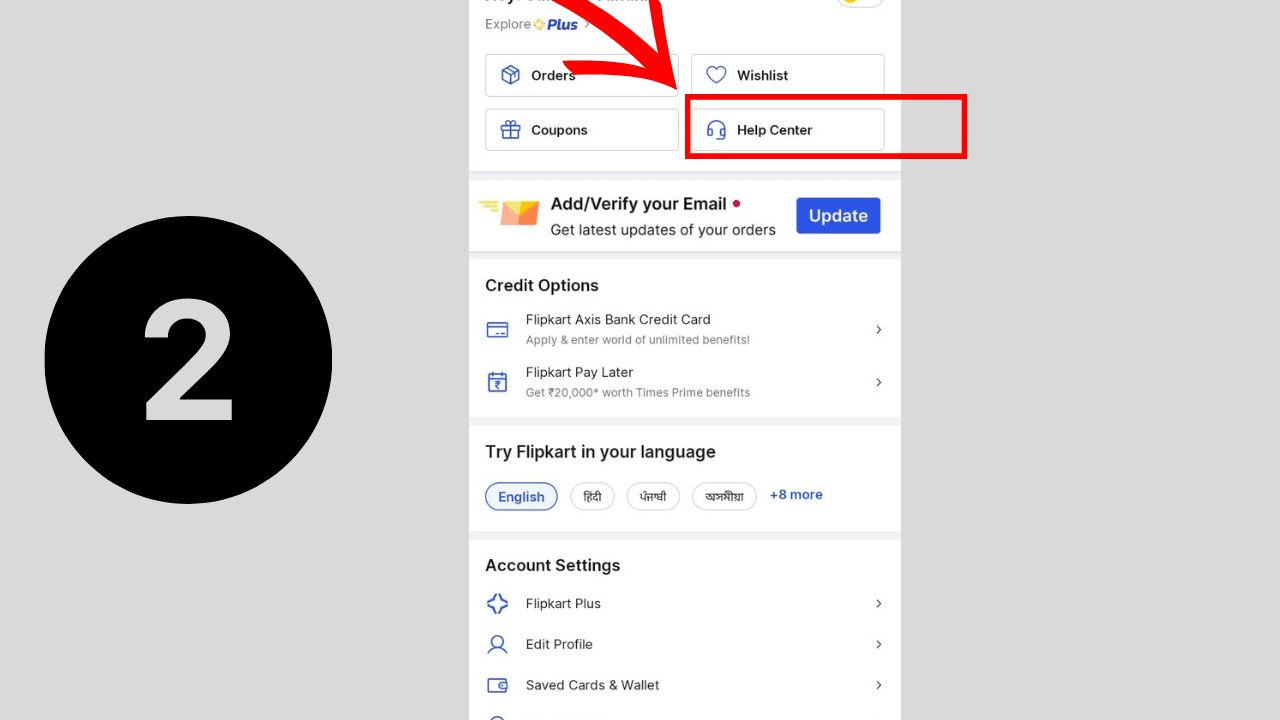

Close Flipkart Pay Later Account Via Flipkart App or Website

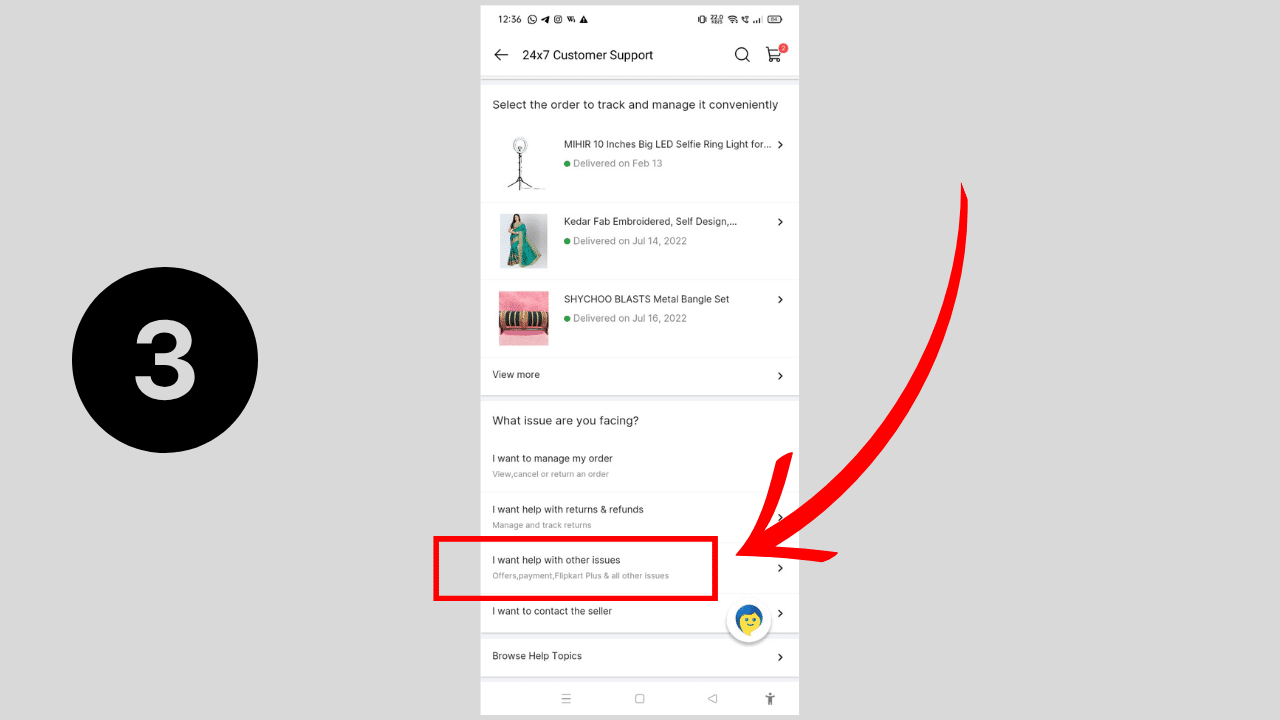

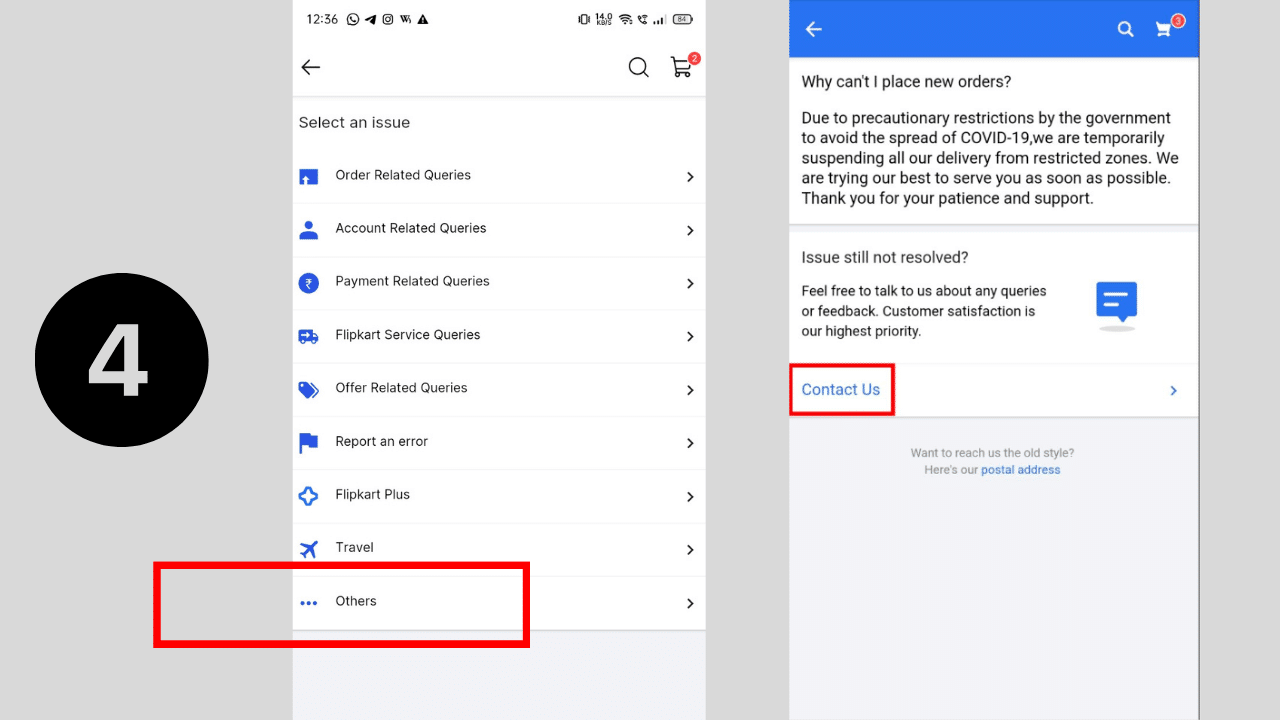

To close Flipkart Pay Later Account, first follow all these steps.

- First of all, log in to your Flipkart account.

- After tapping go to chat or callback option

- After that request a call back from Flipkart customer representative.

- After that, you call Flipkart customer care and ask to deactivate Flipkart Pay Later account.

- Make sure there are no outstanding balances

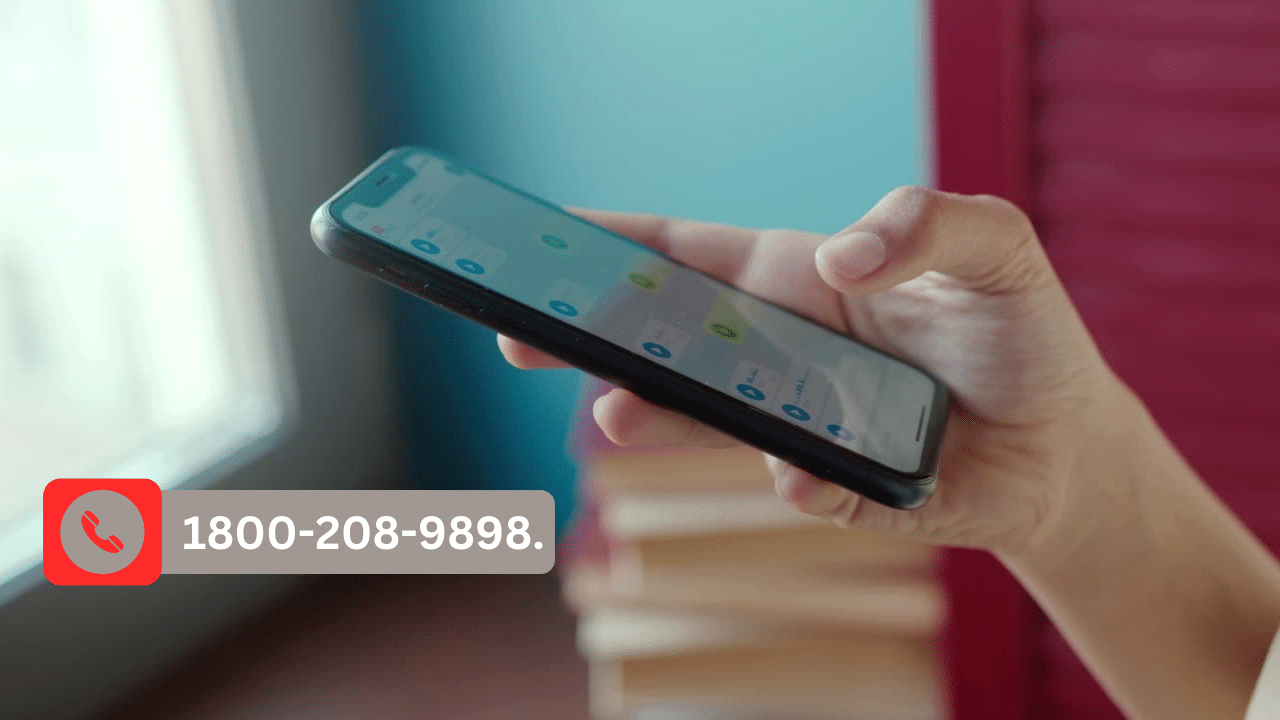

Close Flipkart Pay Later Account Via Call

The easy way to close your Flipkart Pay Later Account through call is given below. By using all those methods you can close your Flipkart Pay Later Account.

- Take your mobile

- Call the Flipcart helpline at 1800-208-9898.

- You ask customer service support to block or close your Flipkart Pay Later Account

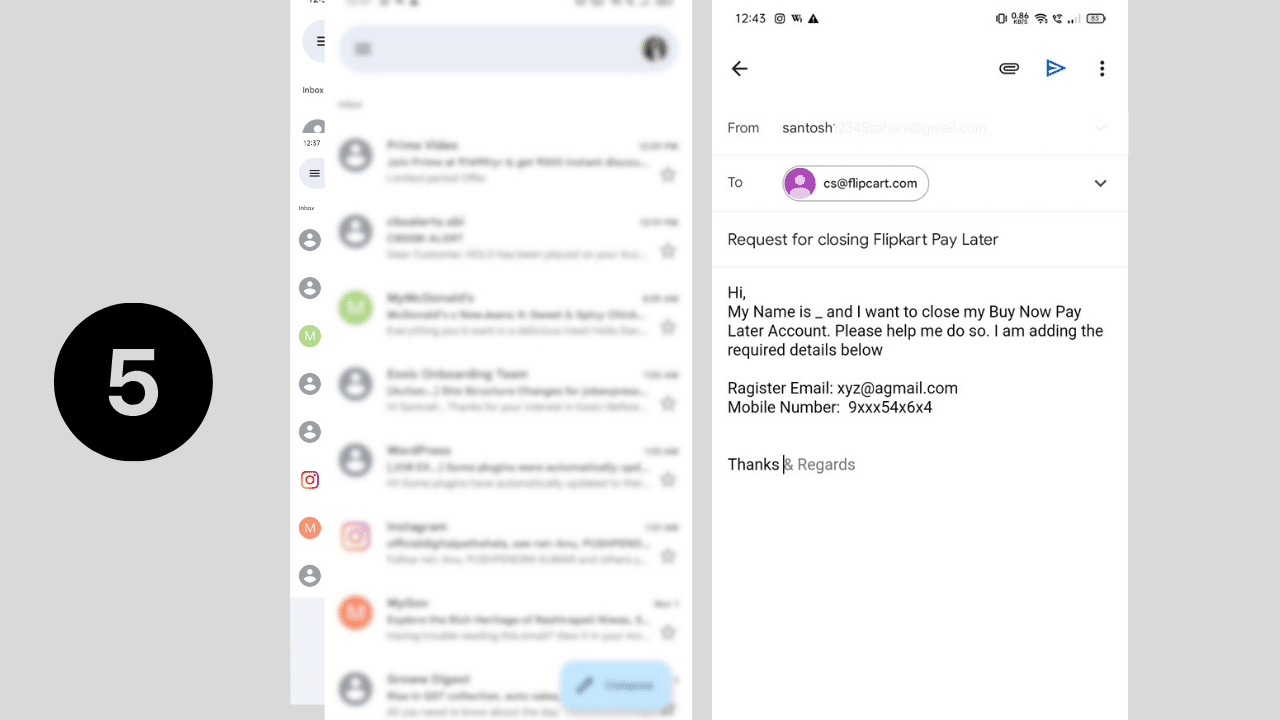

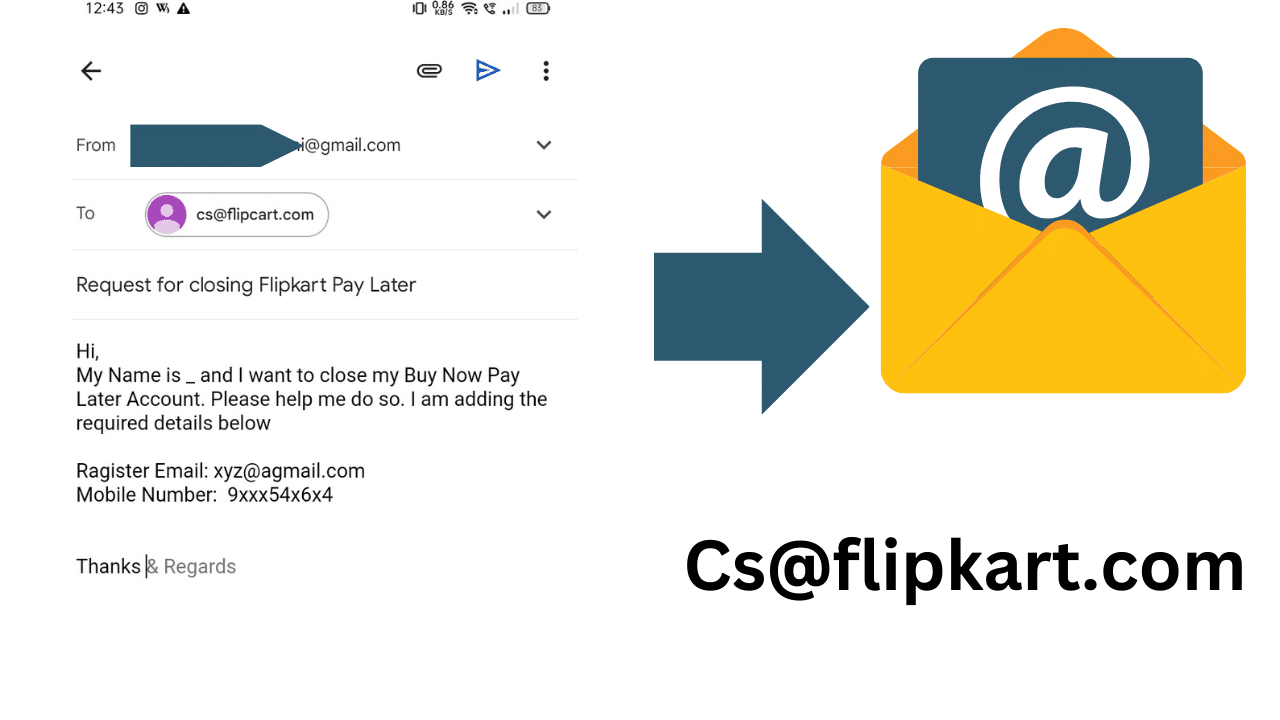

Close Flipkart Pay Later Account Via Mail

- Open your email account

- Write a mail to Cs@flipkart.com and ask the support services to block, and deactivate your Flipkart Pay Later Account

Note – This is not professional financial advice.

Keep these things in mind before closing your Flipkart Pay Later account.

Before closing your Flipkart Pay Later account, keep all these things in mind –

Before closing your Flipkart Pay Later account, pay the outstanding amount in your account. Log in to your account to view your outstanding balance. Your payment will be cleared within 2-3 weeks of requesting account closure

What is Flipkart Pay Later?

Flipkart Pay Later is a customer-centric innovation from Flipkart that offers credit up to Rs 1 lakh per month to purchase items of your choice on Flipkart. With which you can buy the goods immediately and pay for it later. You can convert the entire amount into EMI before the 5th date of payment.

To check your outstanding amount on Flipkart Pay Later, you can follow these steps –

- First of all, log in to your Flipkart account.

- After that click on the ‘My Account’ option.

- Select ‘Flipkart Pay Later’ from the list of options.

- You will be able to view your total credit, available credit, monthly usage, bill outstanding, and other details.

What are the disadvantages of Flipkart Pay Later?

There may be some disadvantages of Flipkart Pay Later like buying the goods now and selling them later. Some possible disadvantages are given below –

Interest Charges – If you do not pay on time, Flipkart Pay Later may charge you interest on the outstanding amount which may increase the total cost of your purchase.

Late Payment Fee – A payment fee is charged if you do not make your payment when it is due.

Impact on credit score – If you do not make payments on time, frequent use of Flipkart’s buy now and pay later feature harms your credit score, making it difficult to secure credit in the future.

The temptation to overspend – Delayed payment facility tempts you to purchase or overspend which can put a strain on your finances.

Limited credit limit – The limit on Flipkart Pay Later can be reduced by the credit limit available from other credit cards.

Limited rewards or benefits – Flipkart Pay Later does not offer as much cashback, rewards, or other benefits as other credit cards.