Today through this blog post we are going to talk about Tata Power Share Price Target 2025, 2027, 2030. Tata Power is an Indian electric utility company that has been in India for more than a century. Tata Power has a strong presence in many states in India and beyond and offers products and services to meet the ever-growing energy demand.

According to earlier reports, Tata Power has recently displayed strong performance. The target values have been established for the years 2023, 2024, 2025, 2027, 2030, and 2050.

Here is the estimated price target for Tata Power shares by years 2024, 2025, 2026, 2027, 2028, 2029, 2030, 2031 and 2035.

Tata Power Share Price Target 2025, 2027, 2030

- Tata Power Share Price Target 2024 – Tata share price targets in 2024 range from ₹309.15 to ₹333.68, with an average of ₹333.68.

- Tata Power Share Price Target 2025 – Tata share price targets in 2025 range from ₹369.52 to ₹428.53, with an average of ₹396.84.

- Tata Power Share Price Target 2026 – Tata share price targets in 2026 range from ₹420.15 to ₹493.73, with an average of ₹461.18

- Tata Power Share Price Target 2027 – Tata share price targets in 2027 range from ₹474.22 to ₹564.59, with an average of ₹517.84.

- Tata Power Share Price Target 2030 – Tata share price targets in 2030 range from ₹651.86 to ₹768.82, with an average of ₹704.89.

- Tata Power Share Price Target 2035 – Tata share price targets in 2035 range from ₹939.79 to ₹1,112.41, with an average of ₹1,021.05.

| Years | Minimum Price Target | Maximum Price Target | Average Price Target |

| 2024 | ₹309.15 | ₹357.26 | ₹333.68 |

| 2025 | ₹369.52 | ₹428.53 | ₹396.84 |

| 2026 | ₹420.15 | ₹493.73 | ₹461.18 |

| 2027 | ₹474.22 | ₹564.59 | ₹517.84 |

| 2028 | ₹532.75 | ₹633.25 | ₹581.70 |

| 2029 | ₹594.30 | ₹698.53 | ₹643.29 |

| 2030 | ₹651.86 | ₹768.82 | ₹704.89 |

| 2031 | ₹710.41 | ₹838.10 | ₹771.49 |

| 2035 | ₹939.79 | ₹1,112.41 | ₹1,021.05 |

It is important to note that the actual share price of Tata Power in 2025 may vary depending on market conditions, economic policy, and world events and factors.

There are many predictions available in the market regarding Tata Power’s price target from 2025 to 2035. You should keep in mind that all these share prices are estimates based on market analysis.

Tata Power Share Price Target 2024

Tata Power’s share price target for the year 2024 is in the range of Rs 300 – 350 based on technical analysis and Rs 393 based on fundamental analysis. However, electricity demand is expected to increase in 2024, which should boost Tata Power’s share price target.

| Tata Power Share 2024 | Minimum Price Target | Maximum Price Target | Average Price Target |

| January | ₹250.26 | ₹299.77 | ₹273.40 |

| February | ₹253.86 | ₹300.92 | ₹275.99 |

| March | ₹255.92 | ₹311.79 | ₹282.09 |

| April | ₹262.90 | ₹312.74 | ₹284.48 |

| May | ₹268.78 | ₹324.63 | ₹293.62 |

| June | ₹276.28 | ₹324.93 | ₹297.98 |

| July | ₹283.28 | ₹333.52 | ₹304.28 |

| August | ₹282.82 | ₹337.92 | ₹310.93 |

| September | ₹287.41 | ₹338.20 | ₹316.56 |

| October | ₹304.83 | ₹351.35 | ₹326.61 |

| November | ₹307.91 | ₹355.41 | ₹330.87 |

| December | ₹307.15 | ₹359.26 | ₹333.68 |

Tata Power Share Price Target 2025

Tata Power’s corporate share price may see a boost by 2025. The company aims to increase clean and green energy capacity by 60%. For which the company is continuously working hard.

| Tata Power Share 2025 | Minimum Price Target | Maximum Price Target | Average Price Target |

| January | ₹312.59 | ₹364.50 | ₹338.22 |

| February | ₹316.81 | ₹366.97 | ₹340.70 |

| March | ₹320.23 | ₹376.64 | ₹348.61 |

| April | ₹326.62 | ₹378.88 | ₹347.75 |

| May | ₹326.01 | ₹379.10 | ₹358.67 |

| June | ₹336.11 | ₹389.94 | ₹363.23 |

| July | ₹336.66 | ₹394.45 | ₹366.68 |

| August | ₹341.59 | ₹404.10 | ₹370.86 |

| September | ₹344.02 | ₹407.62 | ₹377.71 |

| October | ₹361.33 | ₹417.81 | ₹393.35 |

| November | ₹368.57 | ₹426.60 | ₹396.86 |

| December | ₹368.52 | ₹429.53 | ₹396.84 |

Tata Power Share Price Target 2026

Tata Power is India’s largest integrated power company, with a presence across the entire value chain of power generation, transmission, distribution, and trading.

Tata Power’s share price target for 2026 is ₹461.18 and after achieving this target, Tata Power’s share price may move towards its second target of ₹499.73.

The following table shows the estimated share price targets for Tata Power for each month through 2026.

| Tata Power Share 2026 | Minimum Price Target | Maximum Price Target | Average Price Target |

| January | ₹368.44 | ₹433.93 | ₹397.62 |

| February | ₹368.46 | ₹432.01 | ₹400.83 |

| March | ₹384.31 | ₹442.43 | ₹411.72 |

| April | ₹383.73 | ₹447.39 | ₹415.21 |

| May | ₹385.68 | ₹448.90 | ₹414.68 |

| June | ₹393.63 | ₹460.31 | ₹424.39 |

| July | ₹398.77 | ₹464.36 | ₹430.39 |

| August | ₹401.04 | ₹465.74 | ₹431.13 |

| September | ₹403.31 | ₹473.99 | ₹439.88 |

| October | ₹415.71 | ₹490.16 | ₹453.60 |

| November | ₹421.56 | ₹493.11 | ₹458.03 |

| December | ₹419.15 | ₹499.73 | ₹461.18 |

Tata Power Share Price Target 2027

However, Tata Power has started the work of manufacturing solar water pumps along with solar roofs. Tata Power has so far provided service to more than 3,500 people. The annual capacity of this company is 1000 MW. The share target of this company is ₹ 517.84.

| Tata Power Share 2027 | Minimum Price Target | Maximum Price Target | Average Price Target |

| January | ₹425.48 | ₹499.68 | ₹459.03 |

| February | ₹426.22 | ₹502.97 | ₹462.95 |

| March | ₹433.26 | ₹508.65 | ₹470.86 |

| April | ₹430.44 | ₹513.48 | ₹473.99 |

| May | ₹443.53 | ₹520.61 | ₹482.82 |

| June | ₹442.87 | ₹530.80 | ₹490.56 |

| July | ₹452.30 | ₹535.96 | ₹489.50 |

| August | ₹450.71 | ₹542.75 | ₹493.28 |

| September | ₹462.92 | ₹548.59 | ₹505.24 |

| October | ₹469.09 | ₹560.42 | ₹517.79 |

| November | ₹473.69 | ₹567.54 | ₹516.20 |

| December | ₹470.22 | ₹568.59 | ₹517.84 |

Tata Power Share Price Target 2028

Tata Power has another business named Water Pump. Water Pump Company is continuously growing. This company has done business with more than 85000 water pumps so far.

This company is expected to do a business of more than Rs 2.5 lakh by 2027-28. Tata Water Pump generates revenue of more than Rs 5000 crore every year. Talking about Tata Power’s share price target of 2028, its share price is expected to reach ₹581.70 by 2028.

| Tata Power Share 2028 | Minimum Price Target | Maximum Price Target | Average Price Target |

| January | Non | Non | Non |

| February | Non | Non | Non |

| March | ₹490.39 | ₹580.81 | ₹535.53 |

| April | Non | Non | Non |

| May | Non | Non | Non- |

| June | ₹506.74 | ₹600.83 | ₹553.14 |

| July | Non | Non | Non |

| August | Non | Non | Non |

| September | ₹520.09 | ₹611.86 | ₹565.75 |

| October | Non | Non | Non |

| November | Non | Non | Non |

| December | ₹534.75 | ₹629.25 | ₹581.70 |

Tata Power Share Price Target 2029

Tata Power’s 2026 target is ₹461.18 and after achieving this target, Tata Power’s 2029 target is Tata Elxsi share price is expected to reach ₹643.29.

| Tata Power Share 2029 | Minimum Price Target | Maximum Price Target | Average Price Target |

| January | Non | Non | Non |

| February | Non | Non | Non |

| March | ₹546.94 | ₹648.09 | ₹595.13 |

| April | Non | Non | Non |

| May | Non | Non | Non |

| June | ₹566.29 | ₹665.11 | ₹614.74 |

| July | Non | Non | Non |

| August | Non | Non | Non |

| September | ₹580.80 | ₹680.32 | ₹626.51 |

| October | Non | Non | Non |

| November | Non | Non | Non |

| December | ₹595.30 | ₹697.53 | ₹643.29 |

Tata Power Share Price Target 2030

Tata Power is making continuous efforts to develop new energy sources. And Tata Power is expanding its work very fast. For this, they are constantly thirsting to invest substantial amounts of money. For which the company has set a target of increasing clean and green energy by 80%.

| Tata Power Share 2030 | Minimum Price Target | Maximum Price Target | Average Price Target |

| January | Non | Non | Non |

| February | Non | Non | Non |

| March | ₹610.50 | ₹716.37 | ₹661.73 |

| April | Non | Non | Non |

| May | Non | Non | Non |

| June | ₹624.84 | ₹731.39 | ₹673.33 |

| July | Non | Non | Non |

| August | Non | Non | Non |

| September | ₹637.35 | ₹748.60 | ₹695.11 |

| October | Non | Non | Non |

| November | Non | Non | Non |

| December | ₹651.86 | ₹765.82 | ₹704.89 |

Tata Power Share Price Target 2035

If predicted, the company will have grown a lot by 2025. However, the company estimates that it will increase its green energy by 100% in the next 5 to 10 years. The company has installed more than 1 lakh EV charging points to promote green energy.

And most of the charging infrastructure in the country has been completed. Along with this, the management of Tata Power is continuously promoting Tata Group’s ecosystem in the market. Due to this, it is continuously growing in the market. It is estimated that the share price target of Tata Power will increase to ₹ 1,021.05.

| Tata Power Share 2030 | Minimum Price Target | Maximum Price Target | Average Price Target |

| January | Non | Non | Non |

| February | Non | Non | Non |

| March | ₹896.42 | ₹1,056.96 | ₹971.89 |

| April | Non | Non | Non |

| May | Non | Non | Non |

| June | ₹910.77 | ₹1,075.99 | ₹987.49 |

| July | Non | Non | Non |

| August | Non | Non | Non |

| September | ₹927.28 | ₹1,093.20 | ₹1,005.27 |

| October | Non | Non | Non |

| November | Non | Non | Non |

| December | ₹935.79 | ₹1,108.41 | ₹1,021.05 |

Here are some of the pros and cons of investing in Tata Power based on share price targets for 2025, 2027, and 2030. Please read carefully

PROS

Growth Potential – They target a share price of up to ₹333.68 for Tata Power in 2024. Based on technical analysis, electricity demand is expected to increase in 2024, due to which the share price of Tata Power is expected to increase.

Diversified Portfolio – Tata Power has a presence across the entire value chain of power generation, transmission, distribution, and trading. This diversified portfolio can help reduce the risks associated with investing in any one sector.

Sustainability – Tata Power has earned a strong reputation for its emphasis on sustainability and corporate social responsibility. This may be an attractive factor for investors who prioritize environmental, social, and governance (ESG) factors.

CONS

Market Volatility – Share prices are subject to market volatility and may fluctuate depending on various factors such as global economic conditions, company performance, and market trends.

Regulatory Risk – The power sector is heavily regulated by the government. Changes in rules or policies may affect the performance of companies operating in this sector.

Competition – Tata Power faces competition from other players in the power sector. This competition can impact a company’s market share and profitability.

Know what Tata Power Company Details-

India is a great and vast country that is rich in many types of energy sources. The field of power generation in India is progressing very rapidly. Today through this article we will talk about the details and history of Tata Power Company, production and environmental initiatives, and its contributions.

History of Tata Power Company

Tata Power is headquartered in Mumbai, Maharashtra. This company was established in 1989. The main objective of this company is to generate electricity. Tata Power Company is a leading energy company in India.

Tata Power Company’s production

Tata Power Company deals in the field of power generation in India from various types of power sources like wind, solar, gas, and climate sources. Is.

Wind Power – Tata Power Company has built wind power plants that produce electricity using the energy of the wind. It is a natural and pollution-free source and helps in saving the environment instead of damaging the atmosphere.

Solar Power – Tata Power Company has built solar plants to generate electricity using the sun’s energy. Solar power is a clean and inexhaustible source and by using it energy shortage can be reduced.

Gas Power – Tata Power Company builds gas plants, which produce electricity using natural gas or liquefied gas. Gas power plants provide the ability to produce electricity smoothly and provide energy to users at affordable prices.

Climate sources – Tata Power Company has also produced electricity using climate sources, such as climate power plants. In these plants, electricity is produced using energy obtained from nature, and this helps in reducing pollution.

Environmental Initiatives of Tata Power Company

Tata Power Company takes its responsibility towards the environment seriously and supports various environmental initiatives. The company is famous for its efforts towards clean energy and environment-friendly energy.

Clean Energy – Tata Power Company has supported various clean energy sources, such as wind and solar power. These sources help in reducing pollution and making more efficient use of natural resources.

Energy Conservation – Tata Power Company has taken its responsibility towards energy conservation to heart. He uses several technology measures to reduce energy wastage in his enterprises, such as energy usage monitoring and energy saving measures.

Social Responsibility – Tata Power Company also fulfills its responsibilities towards society. The company supports social and environmental initiatives and runs various programs to participate in community development.

Contribution of Tata Power Company

Tata Power Company has made significant contributions to the Indian energy sector. By using innovative technological measures in its production sector, the company ensures the supply of energy, which is essential for the growth of the Indian economy.

Energy Supply – Tata Power Company supplies energy to different parts of India, thereby promoting the development of various regions.

Jobs and Employment – Along with creating jobs in Tata Power Company’s enterprises, the company provides employment opportunities to the people and strengthens their economic condition.

Technological Advancement – Tata Power Company has given priority to technological advancement in the field of energy generation and has tried to make better use of energy sources by using innovative technologies.

Future of Tata Power Company

Tata Power Company has achieved success throughout its history and has earned its place as an important player in the Indian energy sector. The company guarantees a safe supply of energy while reducing pollution by using innovative technologies in its production area.

The future of Tata Power Company also looks very bright. With its leadership and employee strength, the company can play an even more important role in the Indian energy sector and contribute significantly towards prosperity.

Tata Power Business Model

Tata Power’s business model is built on a customer-centric approach while delivering sustainable value creation to each of its stakeholders.

The company maintains a customer-centric approach in its way of doing business by creating value with every outcome.

Tata Power is committed to sustainable and clean energy growth and is shaping the transformation of the power sector through new business models in EV charging, solar rooftop and pumps, microgrids, storage solutions, ESCOs, home automation, and smart meters.

Tata Power’s core business is the generation, transmission, and distribution of electricity. With an installed power generation capacity of 14,076 MW, it is India’s largest integrated power company.

Tata Power has been ranked third in the 2017 Responsible Business Ranking developed by IIM Udaipur.

Tata Power’s business model is built on a customer-centric approach, delivering sustainable value creation to each of its stakeholders.

The company maintains a customer-centric approach in its way of doing business by creating value with every outcome.

Tata Power is committed to sustainable and clean energy growth and is shaping the transformation of the power sector through new business models in EV charging, solar rooftops and pumps, microgrids, storage solutions, ESCOs, home automation, and smart meters.

Tata Power’s core business is the generation, transmission, and distribution of electricity. With an installed power generation capacity of 14,076 MW, it is India’s largest integrated power company.

Tata Power has been ranked third in the 2017 Responsible Business Ranking developed by IIM Udaipur.

Tata Power’s Latest Earnings

Talking about the earnings of Tata Power, in 2022, Tata Power’s earnings are Rs 42,576 Crore and if we talk about operating income, it is Rs 8,191 Crore and its net income is Rs 2,156 crore. Talking about the total assets of Tata Power, the total assets of Tata Power are Rs 112,884 Crore and the total equity is Rs 22,441 Crore.

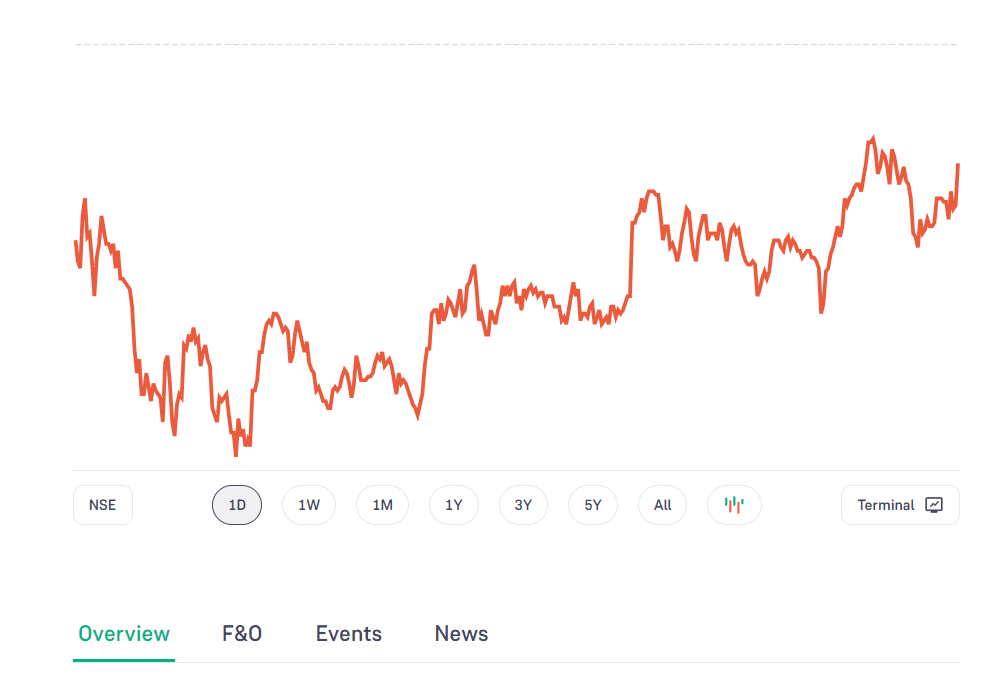

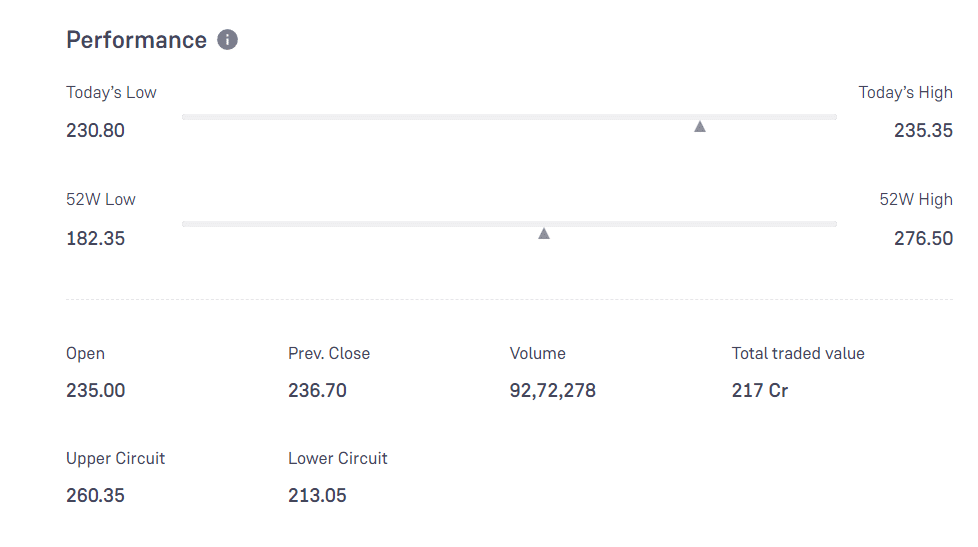

Tata Power technical analysis

The current price of Tata Power shares as of 25 OCTOBER 2023 is ₹236.70. The price reached the highest value of Rs 295 in April 2022.

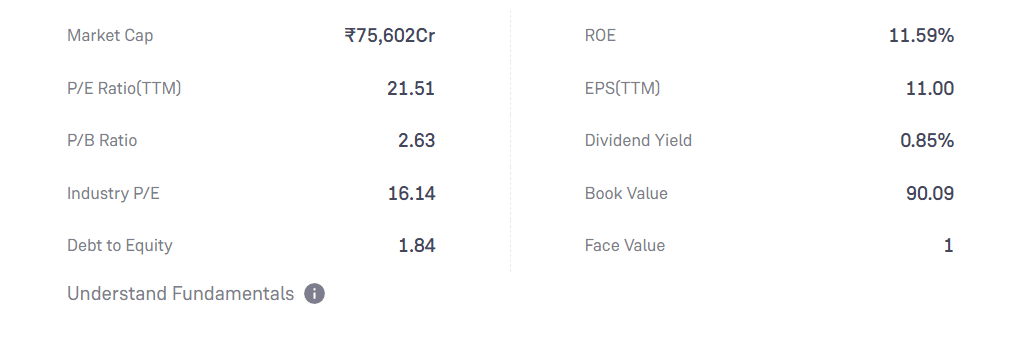

Tata Power fundamental analysis

Conclusion

This Disclaimer is written for knowledge purposes. Before investing in any stock kindly do research and at your own risk.

Before making any investment or taking any decision, you are always advised to do your market research and analysis.

Please note that these are not exhaustive lists of pros and cons. It is important to do thorough research and analysis before making any investment decision.

-

What is the estimated share price target for Tata Power in 2025?

As per an estimate, Tata Power’s share price target for 2024 is between Rs 300 – 350 based on technical analysis and Rs 393 based on fundamental analysis. Electricity demand is expected to increase in 2024, which will boost Tata Power’s share price target.

-

What could be the estimated share price target for Tata Power in 2027?

As per an estimate, Tata Power’s share price target for the years 2023, 2024, 2025, 2027, 2030 to 2050 is in the range of Rs 250 – 300, Rs 300 – 250, Rs 350 – 400, Rs. Rs 500 – 550 and Rs 650 – 700 respectively

-

What are the factors influencing Tata Power’s share price target?

Factors influencing Tata Power’s share price target include market trends, company performance, global economic conditions, and government regulations and policies.

-

How has Tata Power’s share price performed in recent years?

In the last year (Oct ’22 – Oct ’23), Tata Power’s share price was Rs has ranged from Rs 150 to Rs 250.